Women up and down the country have been holding their breath, waiting to see what will happen when the EU gender ruling covering insurance came into force on December 21st, 2012. We looked at this in a previous post. At the time, it wasn’t clear how premiums would be affected.

We now know that women could find themselves paying up to £500 more than they previously did. This obviously has a lot to do with your cover and the company with whom you have your insurance. One thing’s for certain, premiums will rise to a lesser or greater extent for all women, regardless of who your policy is with.

Premiums for young women could rise by 25% thanks to G-Day’s changes

People within the industry have referred to December 21st as G-Day. Insurance providers are no longer allowed to adjust their premiums according to a driver’s sex, due to the 2011 ruling by the European Court of Justice.

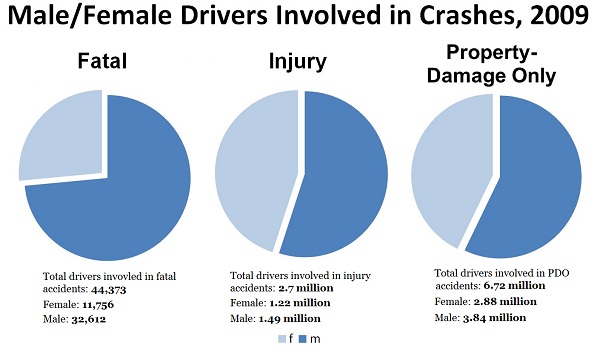

In the UK, we have a long tradition of women paying lower premiums for car insurance. In many cases they’ve paid considerably less than their male counterparts. Now the ruling has come into force, insurance industry experts say that premiums for young women drivers could see an increase of up to 25 %. The change doesn’t just affect motoring, because the cost of life insurance for women is also set to rise by as much as 20 %.

The car insurance price rise could be daunting for young women in particular when they see their outgoings soar. An increase of 25 % will typically push the total cost of premiums up by £531. The AA says a young women driver in the 17-22 age bracket, has paid an average premium of £2,057 up until now. Men in the same age group already pay premiums of over £3,000. However, some insurance companies haven’t yet released figures showing how much they will charge women drivers under the new gender rules.

There is a silver lining to all of this. Women could see themselves gaining financially in retirement. Annuity rates could mean that they’ll see a better income during retirement which is estimated at 6 %.

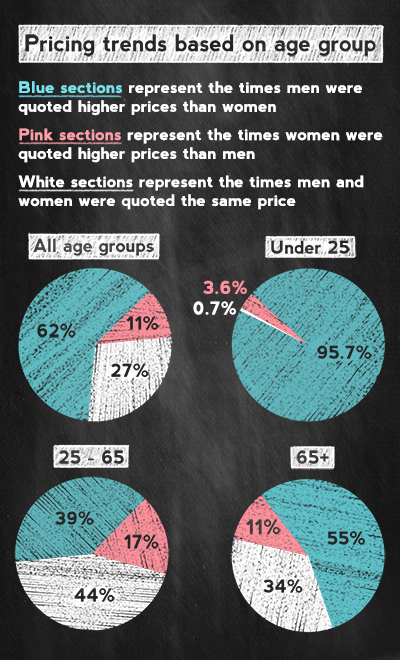

Chief executive of Consumer Intelligence, Ian Hughes, described the current condition of the UK’s car insurance market as chaotic. An overall analysis of the industry by the market research group, has shown that the premiums from gender neutral insurance providers had risen typically by 12 %. Hughes went on to say that companies had raised premiums, but a few had actually slashed them prior to G-Day, in a bid to win over women before the rules came into force.

The changes have meant that women now have to pay more right across the board, with one company raising premiums to the tune of 26 % for younger women drivers. This means that their premiums have risen, on average, to £2,909. Another insurance provider has stung women in the older age bracket with an even higher increase. A woman aged 44 has to pay 43 % more on their premiums, bringing the new cost up to £1,402.

The 90 day quote could be phased out

Head of Gocompare.com, Scot Kelly, said that the motoring insurance price comparison website couldn’t predict exactly how the changes would pan out during the next twelve months. He was able to say that they expect the premiums for women drivers to continue rising. Insurance companies aren’t just raising their premiums however. They are also reducing the duration for which quotes are valid. It’s been the norm for insurers to give a quote, and this would usually be valid for 90 days. This has been useful for motorists, as it meant that they had plenty of time to shop around for a better policy, with cheaper premiums. According to market research group, Consumer Intelligence, insurers are now planning to give quotes that are valid for just 30 days. Validity periods have even been cut to just 14 days by some insurance companies. Others have only held their quotes until the new EU gender ruling came into force on December 21st.

Life insurance companies have been rather more tight lipped on the changes, with only three of them announcing their new prices. One of the companies, Legal & General, has announced that the average cost of life insurance for women has gone up. Upto 23 % in some cases. However, men’s premiums have fallen by 3 %. This means the rates for each sex are now balanced at 17 %, on average, for its whole-of-life policies.

The fact that car insurance premiums have risen for all women has resulted in a lot of grumbling! If you’ve taken out a motor insurance policy after G-Day (December 21st), you will have paid more than if you would have done, if you’d taken out a policy in the weeks prior to the European rule changes. So, the days of women enjoying much cheaper insurance premiums are over, although the advice on shopping around still applies. However, motorists, in some cases, may no longer have the luxury of having a 90 day quote, which would give them enough time to shop around and find the best deal. Motorists are going to need to be more organised if they want to find the best buy!