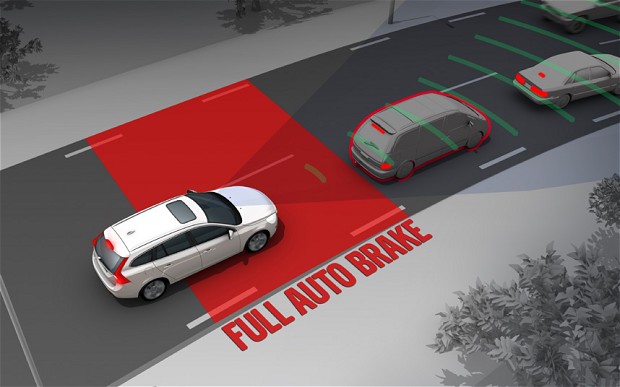

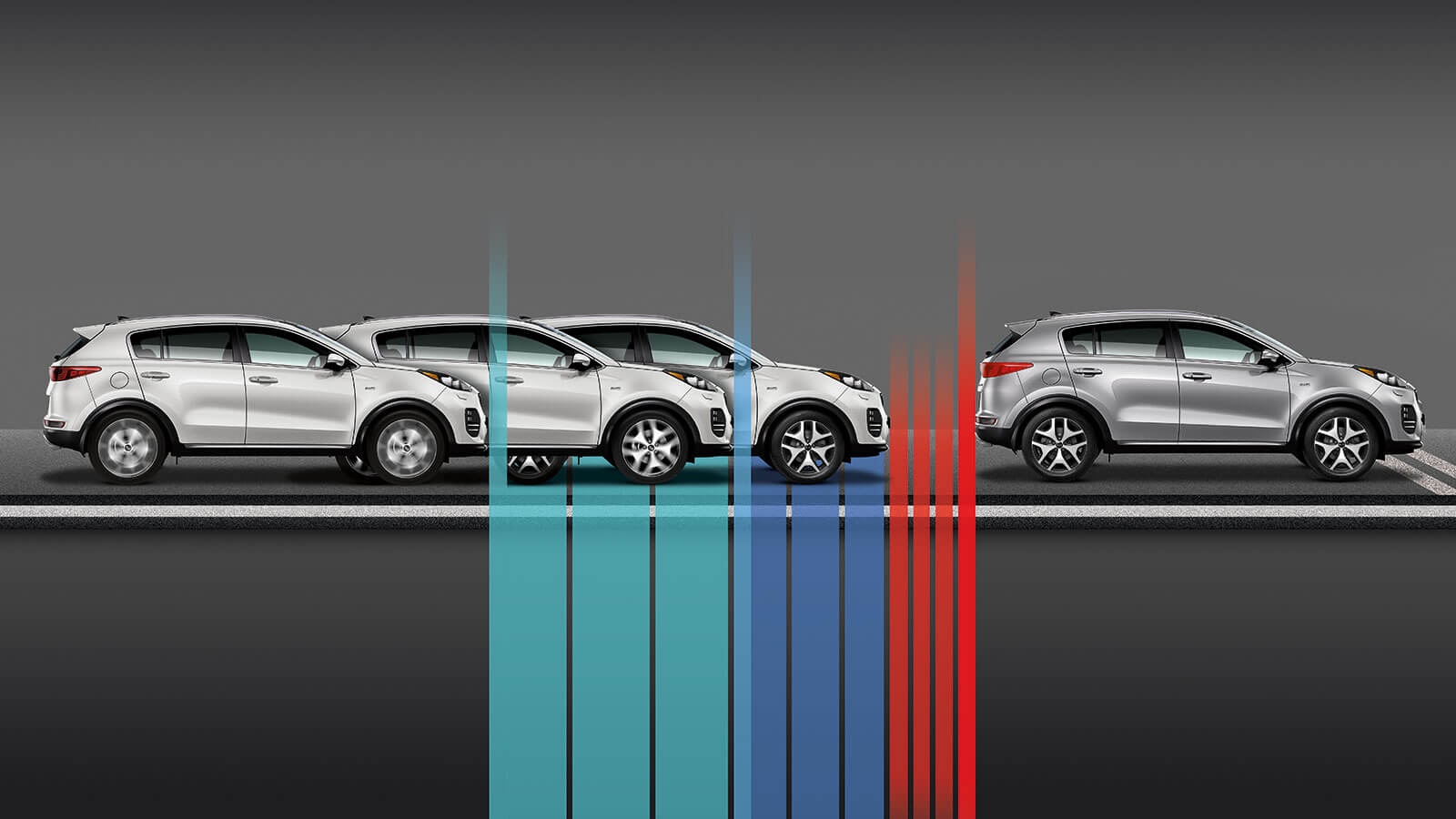

In case you’re wondering what this AEB is all about. It’s basically a system that can detect and avoid imminent collisions by slamming on the brakes if the driver doesn’t take action first. It’s worth noting that it’s just not possible to avoid all accidents, but if the worst happens AEB can drastically reduce the severity of the collision.

These systems use a combination of technologies like video-recognition, radar and other sensors. These all measure the distances between your car and other vehicles and give a warning if other vehicles get too close. The system can automatically apply the brakes if the driver fails to respond. So far, this technology is available on several new models. Some Ford, Volvo and Volkswagen vehicles employ AEB at the moment, and insurance companies are rather impressed.

The Insurers Research Centre, Thatcham, Berkshire has recently carried out its own study of AEB. The centre has also run tests on AEB systems for the European crash test organisation Euro NCAP. They found out that AEB reduces accidents, injuries and fatalities. A study conducted by the Insurance Institute for Highway Safety in the Unites States also confirms this.

Volvo owners whose vehicles were fitted with AEB systems made 25% fewer claims than owners of comparable vehicles. Meanwhile, Tristar Worldwide, the chauffer company from Middlesex, UK has seen AEB technology in action during their six month trial which used cars with AEB systems. The company reported that there had been a 28% fall in its drivers having rear impact collisions where they were at fault.

Owners of vehicles with AEB technology won’t be the only ones to benefit. Could AEB lead to cheaper insurance premiums for all? Some have answered yes, because those who don’t have AEB fitted could benefit in the long run from fewer whiplash claims. Some insurance companies have estimated that such claims could fall by as much as 160,000.

The insurance Group Rating for vehicles fitted with Autonomous Emergency Braking could well end up being slashed by up to five groups, thanks to Thatcham and their research for UK insurers. If this is the case, we’ll inevitably see drivers being tempted into buying safer cars to reap the benefits of the cheaper car insurance premiums. This also means that we’ll see fewer accidents, fewer people being injured and a reduction in deaths. It’s great news for everyone that drivers will be rewarded for making more safety conscious choices when they buy a new car.

In fact, the European Commission sees great potential in Autonomous Emergency Braking systems. So much so, that plans are now underway to make this a mandatory requirement for all new vehicles by 2014. The commission’s own research found that AEB could cut road traffic accidents by up to 27%, which translates as around 8,000 lives being saved each year. So far, this is only planned for the continent, and it’s not yet clear whether the UK will follow Europe’s lead.